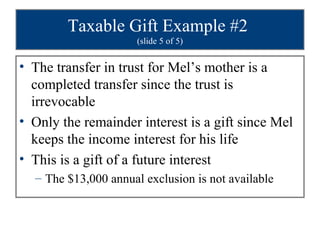

what happens if i gift more than the annual exclusion

Contributions to 529 plans Coverdell ESAs and UGMA UTMAs are all treated as gifts subject to annual exclusion amounts. Gifts to your US-citizen spouse either outright or to a trust that meets certain requirements or gifts to your noncitizen spouse within a special annual exclusion amount 155000 for 2019.

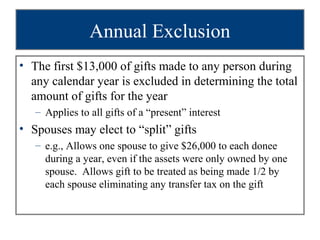

Gift tax is a federal tax on money or assets you give that are worth more than the annual exclusion of 16000 in 2022.

:max_bytes(150000):strip_icc()/GettyImages-1163111044-14c649c9ea4746ba9d5ca30a060fde66.jpg)

. So up to the total of 30000 to that child. So we can count that. Has a lifetime gift tax exclusion of 114 million indexed for inflation.

If you have not exceeded the limit of 534 million in total gifts given there will be no gift taxes owed. If you gift more than the exclusion limit to a recipient youll need to file tax forms to disclose those gifts to the IRS. If giving above the annual exclusion amount is as.

If all your gifts for the year fall into these categories no gift tax return is required. The year resets and restarts on Jan. Well I think that you have to think about - each of us can make a gift of 15000 a year to someone and thats something called the annual exclusion gift tax exclusion.

But very much like the fairy godmothers warning in the story of Cinderella the exclusion amount is currently set to revert back to its previous amount of 5000000. The actual amount in 2019 is 11400000 or 22800000 for a married couple. The exclusion amounts currently available for the federal gift and estate tax and generation-skipping transfer tax sometimes individually or collectively referred to as transfer taxes may prove to be a once-in-a-lifetime opportunity to pass significant wealth to children grandchildren and more distant generations in a tax-efficient manner.

The federal government imposes a tax on gifts. If you exceed the annual gift exclusion youll need to report that gift with the IRS but there are likely to be no lasting tax consequences for you. The reason is that 117 million lifetime gift exclusion amount.

What happens if I gift more than the annual gift tax exclusion. If you give more than the annual exclusion amount you simply have to file a Gift Tax Return IRS Form 709. This is done using Form 709 - United States Gift and Generation-Skipping Transfer Tax Return.

This increase in the estate and gift tax exclusion is due to the Tax Cuts and Jobs Act TCJA. 20 2018 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to drop to pre-2018 levels. Caution on Using the Lifetime Exclusion.

May 31 2019 446 PM. The gift limit for 2014 is 14000 to each individual without having to file a gift tax return Form 709. What happens if i gift more than the annual exclusion Sunday June 12 2022 Edit Section 66--29--116 of Tennessees Uniform Disposition of Unclaimed Personal Property Act is preempted to the extent that it permits gift certificates store gift cards and general-use prepaid cards as defined in 100520a to be declined at the point-of-sale sooner than the gift certificates.

If grandparents gift several thousand dollars to each of their grandchildren each amount will be considered separately toward its own annual exclusion. More than that amount you are expected technically to file a federal Form 709. However as the law does not concern itself with trifles 1 Congress has permitted donors to give a small amount to each beneficiary of their choosing before facing the federal gift tax.

In 2019 the annual exclusionary gift is 15000. The final and most significant nuance to the federal gift tax system is that every individual in the US. If you give away up to but not more than 15000 per person in a calendar year whether in cash or other property of value then you definitely are not required to file a federal tax form known as a Form 709.

You dont actually owe gift tax until you exceed the lifetime exclusion which is 1206 million in 2022. This amount is known as the annual exclusion amount which for 2022 is 16000 per beneficiary. That amount is called the annual exclusion.

If youre married then you and your spouse can each give 15000 in that example. The IRS formally made this clarification in proposed regulations released that day. Every year the IRS sets an amount of money that a gift-giver can give to a recipient free from taxes.

In 2018 the annual exclusion will be 15000 in 2017 it is 14000. You need to file a gift tax return using IRS Form 709 any year in which you exceed the annual exclusion. Deductible charitable gifts and.

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Gift Tax Do I Have To Pay Taxes On A Gift Gift Tax Calculator

Gift Tax Returns When To File Even If You Re Below The Annual Exclusion Amount

Gift Tax Do I Have To Pay Taxes On A Gift Gift Tax Calculator

The Gift Tax Filing And Payment Deadlines Have Been Extended To July 15

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

How To Avoid The Gift Tax Paying Bills Owe Money Money Tips

I Bond Gift Option Double Down On Current 8 53 Yield Seeking Alpha

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

The Estate Tax And Lifetime Gifting Hong Kong

The Hidden Costs Of Making A Gift Snyder Law

/money-for-you-172411636-fbc9ab4f707a49c08e17bc07f45f3f1d.jpg)

/GettyImages-1281250043-3b4213b8957f44f3a26eedfcc5e627e7.jpg)